Normal Person Explaining the Stock Market: How it Works & How to Invest

- September 7, 2022

-

Gino D'Alessio

Gino D'Alessio

- Stock Trading Teacher

- stock market

- No Comments

How would a normal person explaining stock market go about it? Let’s start with a brief history of the stock market and proceed with how it works today. Then we’ll also go through the main terminology and how you can invest.

First, let’s just make a point. The stock market serves a very important function in the economy. It’s like the engine oil of your automobile. You need that oil or your car’s engine will stop working as all the moving pieces seize together.

The stock market is one of the main ways a company raises cash to fund its operations. For example, a company that sells lampshades and wants to produce a new line of products. They can go to the bank, which will charge interest, but they can also go to the public and raise that cash from investors.

History of the Stock Market

Let’s have a look at where this concept of going to the general public to find people willing to invest in a company started. And why investors would place their hard-earned cash in such a venture.

One of the first records we have on our books of the individuals investing in a company is those of the English and Dutch East India Companies. They were set up to take advantage of the silk trade routes between Asia and Southeast Asia at the beginning of the 1600s.

These companies required large amounts of cash to finance the many ships they could put to sea to trade silk, gold, porcelain, and spices all around the world. So, what they did was go to coffee shops and shipping ports to find people willing to invest in their ventures.

Investors willing to put their money in these companies were given a share of the possible profits. However, do not think that it was an easy choice to make. People at the time were very aware of the risks of sea voyages.

But with the risk came substantial compensation. The shares that these investors purchased gave them ample compensation after voyages were completed successfully. And with the new finance, the companies could place even more ships to sea and increase their trading activities and their profits.

Video of Normal Person Explaining Stock Market

How the Stock Market Works Today

The stock market today works by and large under the same principle from back in the early 1600s. A private company wants to raise capital to expand its operations and continue its programmed growth. Or it may have found itself in an unexpected situation and now wants to take advantage of a faster growth rate, for which it needs cash.

In simple words, a corporation that wants to expand and make the most of its business model may find itself at a point where it needs more cash. While this is where investors may be interested in buying shares, or stocks, in the belief the company will show a large profit in the future.

Issuing large amounts of shares allows a company to raise capital for all of its needs. Shareholders then elect the managing directors of the company. Who in turn act in the best interest of the company’s shareholders.

Publicly traded companies are obligated to publish all reports and balance sheets creating transparency for their shareholders. Top management is continuously working on how to improve shareholder value. Their performance is also reflected in the stock’s price.

What Is a Stock?

So, what exactly is a stock? A stock is a security that demonstrates an investor’s right to participate in the benefits of a corporation’s activities. A company may have 100 shares of common stock. Let’s say you buy one share; you now own 1/100th of that company. And you will participate in any earnings for your stake in that company.

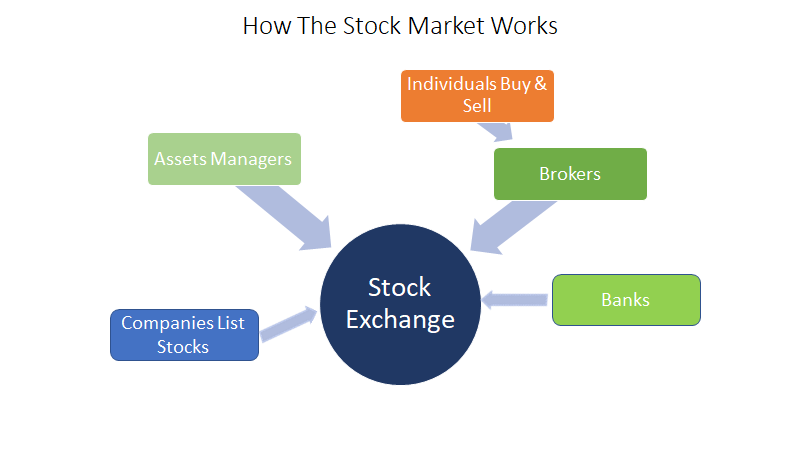

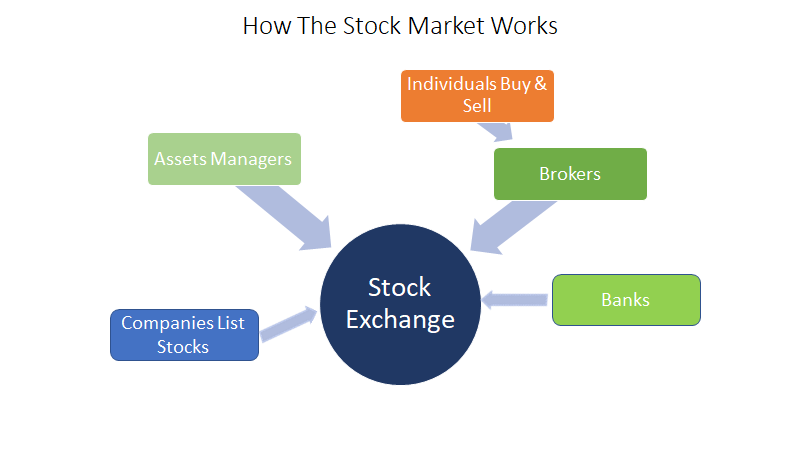

Stock Exchange

All companies have stocks whether they are private or public. However, when we talk about the stock market, we refer to the stocks of companies that are public. This means the stocks of these companies are listed on a stock exchange.

A stock exchange is a centralized organization that lists all the stocks of companies that want their shares available to the public through the exchange. The exchange holds and exchanges stocks from sellers to buyers.

The exchange also publishes all the data relative to the daily trading activities of a company’s stock. Data such as the volume of shares exchanged each day or maximum and minimum prices at which the stock changed hands. This feature creates a lot of transparency for all investors.

This organization also takes care of making sure that a buyer of a stock will receive the shares they paid for, and that the seller will receive the cash for the stocks sold. Exchanges typically only trade with brokers, large banks, and some other large financial institutions.

Initial Public Offering or IPO

As a normal person explaining stock market, I cannot skip the IPO. Often, we hear about this or that company will be doing an IPO, but what does it mean exactly? An initial public offering is when a private company decides to go public.

A private company’s shares are held by investors, institutional or individual people, just like the stocks on the exchanges. However, the company’s stock is not quoted on an exchange. This has its advantages, but we won’t go into that now.

At some point, the company may need to expand its operations and its business model. To do so, the company has various options. However, the most cost-effective is to issue shares to the public. The shares give the shareholder the right to participate in any profits. However, if the enterprise is unsuccessful the company will not have to pay anything back.

Often startups that received funding from funds and other investors find themselves valued at many multiples of the cash that was initially invested. So, the founders and the start-up investors may simply want to cash in on the new and high evaluation of their company. The best way to do this is to offer shares to the public, where altogether investors sum up trillions of dollars.

Stock Market Fluctuations

This is where things can get messy. The stock market is renowned for its capacity to increase in price and drop in price just as easily. This is what is known as volatility. Simply, the action of a stock’s price changing, either up or down. And when the length of those swings is larger, then so too is volatility higher.

Volatility represents something different depending on whether you are a trader or an investor. For traders, volatility represents the possibility of making large sums of money if they get the direction right. However, it can also mean large losses when they are on the wrong side of the trade.

Volatility is also created from expectations. When the general sentiment is that a company can greatly improve its current revenue and profit stream, the price will increase greatly. Sometimes, it’s a simple news headline that generates positive speculation.

For example, an internet technology company that just hired one of its competitors’ CEO can see a large jump in price as investors price better growth prospects from the new hire. Other news can be a large mineral find for a mining company. The news by itself does not change the current situation, but it changes the forecast of future performance.

For the savvy investor, volatility may represent the opportunity to buy more of a stock at a cheaper price or sell a part of their stocks to reap some profits. In either case, timing these events is a tricky business. Many companies offer their stock picking services to help investors and traders.

(Not sure where to start when searching for stocks? You can check our list of the top stock pickers here.)

Stock Market Terminology

Here are some of the main stock market jargon and their explanations.

- Bid Price: This is the price at which an investor or trader is willing to buy the stock.

- Offer or Ask Price: This is the price at which a seller is willing to sell the stock.

- Short: This means an investor or trader no longer has a position in that stock.

- Sell Short: This is the action of putting on a sell trade when you don’t already own the stock. To do this you borrow the stocks from someone who does have them.

- Margin: This is the cash you have on the broker account that allows you to buy and invest in stocks for larger amounts.

- Margin Call: This happens when your account sees a drop in cash due to trading losses, and the broker requests you refund the account to the minimum limit.

- Leverage: This is the number that defines how much more you can buy than the cash you have on your account. For example, 3-to-1 leverage means you can buy 3 times the value you have on your margin account.

- Earnings Release: This is the day companies publish their actual revenues and profits. Big gaps in stock price can open up when their earnings reports are out of line with expectations. Basically, they are dangerous as they can create large bouts of volatility.

Trading the Stock Market

Trading stocks involves buying and selling stocks that are publicly listed. The idea is to use fundamental or technical analysis, or a combination of both, to decide which trades to place. The decision falls on the trade that would appear to have the most likelihood of success.

Fundamental analysis looks at the company’s hard data to determine its growth predictions. Things like price-to-earnings ratio and book-to-market along with other criteria from a company’s balance sheet. It’s more often used for evaluating a company for long-term growth prospects.

Technical analysis looks at how the stock’s price has been performing recently. And uses a series of technical tools, which include indicators, price patterns on charts, drawing tools, and trading volume. It’s an analysis based solely on the fact that human behavior tends to repeat itself. So, applying technical indicators and tools allows predicting to some degree which direction a stock’s price will move next.

Often traders use a mix of fundamental and technical analysis. A technical trader looking at a stock is going to be aware of when the company is going to issue its next earnings report. That is fundamental data, but most likely he won’t want to be open on that day.

If the report is way off expectations, then the trader may initiate a trade to take advantage of the unexpected good or bad news. However, on a day-to-day basis, this type of trader will concentrate mostly on the technical aspects of his analysis.

Day Trading & Swing Trading

Day traders open and close their trades on the same day. They often use high levels of leverage to take advantage of small price moves within the day. They are mostly concerned with technical analysis as fundamental analysis has a much longer time horizon.

Swing traders take positions in the stock market that last from a few days to a few weeks. They are considered medium-term traders. They also look at technical analysis mostly to see when a stock is most likely to make a sustained move. However, they may also look at fundamentals to see if that also backs up their technical analysis.

How to Invest in the Stock Market

You can buy and sell shares at pretty much any bank. Or, if you are going to be active you can also use the services of a stockbroker. Most of the large stockbrokers also offer their services for other assets such as ETFs, options, forex, or bonds.

Most broker houses allow you to do everything online. You will need to provide identification documents and link your broker account to your bank account to fund your margin. The whole process shouldn’t take more than a couple of days.

If you are going to be very active, remember that according to the SEC rules there are limitations as to how often you place day trades. A trader that opens and closes four or more trades on the same day per week is denominated a pattern day trader. And must hold at least $25,000 in their account.

Bottom Line

Trading the stock markets is a tricky business you can read more about stock trading here. Before you leap into the amazing world of stock markets, learn as much as you can about the whole process. The stockbroker you chose is a good place to start and should have plenty of educational material.

However, there’s no need to go it completely alone either. There are so many stocks, and so much information, that it can be extremely hard to stay on top of everything.

Luckily, several companies offer their newsletters to help you make better decisions. We have filtered out a list of the top ones, which you can read about here. These newsletters will save you hours of research and will put you in the know when it comes to the hottest high-upside stocks on the market.

Gino D’Alessio is a Broker/Dealer with over twenty years experience in various OTC markets such as Bonds, FX and Derivatives. Currently a Financial Markets and Investments Writer & Analyst